DOWNLOAD THE PDF VERSION OF THIS PAPER

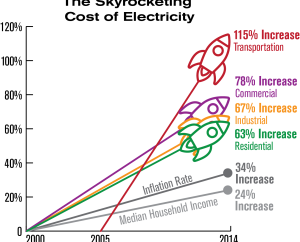

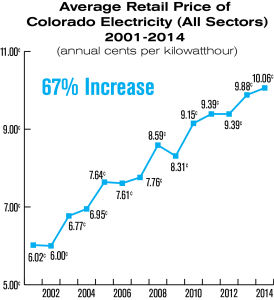

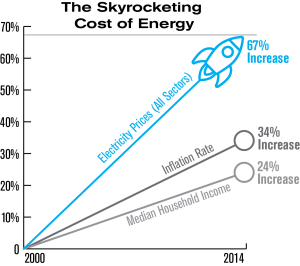

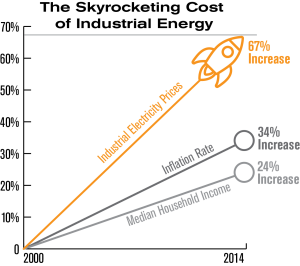

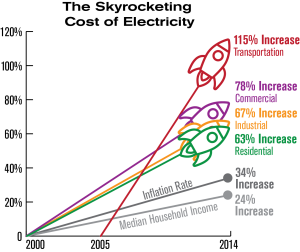

Across all sectors of Colorado the cost of electricity has skyrocketed more than 67 percent between 2001 and 2014, easily exceeding median income growth and the expected rate of inflation for the same period, an extended analysis of government energy records by the Independence Institute has revealed.

For all sectors between 2001 and 2014, the cost per kilowatthour jumped from just over 6 cents to more than 10 cents, or 67.11 percent.

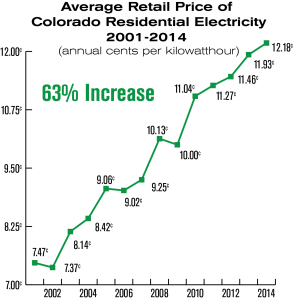

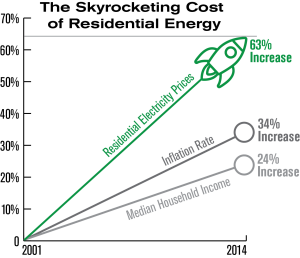

Data obtained by the Independence Institute from the Energy Information Administration and the U.S. Census Bureau showed an increase in electricity rates for residential, commercial, industrial, and transportation sectors throughout the state contributing to the across-the-board growth in prices. In November, the Energy Policy Center reported a staggering increase of 63 percent for residential customers in Colorado.

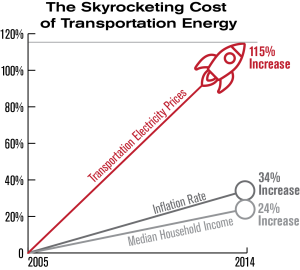

“Retail residential electricity rates increased from 7.47 cents per kilowatthour in 2001 to 12.18 cents per kilowatthour by 2014, a 63.1 percent hike. Coloradans’ median income, however, went up just 24.1 percent, from $49,397 to $61,303. Median income in Colorado actually declined between 2008 and 2012,” the report concluded. It also noted that the U.S. Bureau of Labor and Statistics projected just a 34 percent increase in inflation for the 14 year period, using the agency’s CPI inflation calculator.

And while the data for late 2015 from the BLS indicated a modest decline of 2.9 percent in electricity prices for the Denver-Boulder-Greeley census area, this drop in rates did not offset the 3.8 percent increase seen one year earlier. While global commodity prices have given Colorado energy consumers a brief respite (and wild fluctuations in prices), electricity generation and costs have proven less volatile.

“The energy index, which includes motor fuel and household fuels, decreased 19.0 percent from the second half of 2014 to the second half of 2015, following an increase of 0.3 percent in the same period one year ago. Falling prices for motor fuel (-26.0 percent), all of which occurred in the first half of the period, were largely responsible for the decline in the energy component. Lower prices for utility (piped) gas service (-18.9 percent) and electricity (-2.9 percent) also contributed to the decrease. During the same period one year ago, motor fuel costs declined 3.1 percent, while the indexes for utility (piped) gas service and electricity rose 5.8 and 3.8 percent, respectively,” the BLS report concluded.

Analysis from the earlier November report on residential electricity rates stands confirmed and, indeed, underscored:

It’s clear from the data that Coloradans’ income is not keeping pace with almost continuous electricity price increases over the past 15 years, consistently outpacing the rate of inflation. Colorado’s ratepayers have had to endure two economic recessions over that period, while feeling no relief from escalating energy prices driven by onerous regulations driving energy costs ever higher.

From fuel-switching and renewable mandates to other costly regulations imposed by state and federal agencies, Colorado’s ratepayers and taxpayers alike have been subject to policies that do not consider energy affordability or reliability as a primary concern. The most vulnerable communities–elderly, minorities, and the poor–are the most sensitive to even the smallest increases in energy costs.

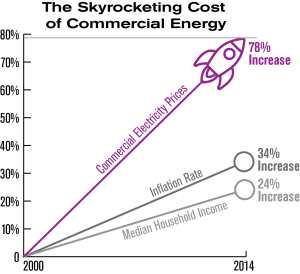

Not to mention the state’s many business owners, including small business owners, who face the same hikes in energy costs that could force decisions like layoffs or relocation to nearby states, where energy costs are lower. This reduces job growth and harms the state’s economy twice, with increased business costs passed on to consumers–the same ratepayers who already are paying more at the meter.

Upshot: the data for the remaining sectors emphasizes the double impact that increased energy costs have in the form of rapidly escalating electricity rates on Colorado ratepayers, who see not only their own personal energy costs rise, but are hit a second time by commercial, industrial, and transportation charges that are “baked into” the cost of providing goods and services that are passed on to consumers.

William Yeatman, senior fellow of environmental policy and energy markets at the Competitive Enterprise Institute and author of the Independence Institute’s 2012 Cost Analysis of the New Energy Economy, said in the November report that given the current regulatory climate, things “could get much worse.”

Some of the costs already baked in to electricity prices came directly from policy initiatives undertaken in the last decade.

Yeatman analyzed 57 legislative items included in the push for a “New Energy Economy,” determining that as much as $484 million in additional costs were incurred by the state’s Xcel customers–an additional $345 per ratepayer.

“The best explanation for this confounding upward trend in utility bills nationwide is the Obama’s administration’s war on coal. Colorado, alas, was well ahead of the curve on the war on coal, which explains much of why the state’s rate increases are presently so much greater than the nationwide average,” Yeatman said.

Part of the war on coal, the Environmental Protection Agency finalized the Clean Power Plan in August 2015.

The policy battle over the EPA’s Clean Power Plan, and the future of Colorado’s electricity rates, rests upon multi-state legal challenges to the agency’s authority that just last week resulted in a stay from the U.S. Supreme Court. That decision was overshadowed, however, by the subsequent death of Justice Antonin Scalia days later, leaving the legal challenge in turmoil given the SCOTUS’ delicate and likely 4-4 ideological split and the contentious election year battle over nominations to replace Scalia.

Meanwhile, Governor John Hickenlooper remains committed to pushing for a“prudent” continuation of planning for Clean Power Plan implementation, with the Colorado Department of Public Health and Environment proceeding with its pre-stay timeline. Colorado Senate Republicans, however, called ignoring the court’s stay “unacceptable.” Legislation addressing CDPHE’s ability to proceed with CPP planning will likely be introduced before the end of the 2o16 Colorado legislative session.

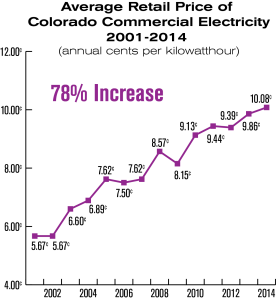

The Independence Institute’s analysis of electricity costs, broken down by the other sectors, shows commercial electricity rates for Colorado have seen a 77.78 percent increase from 2001 to 2014, jumping from 5.67 cents per kilowatthour to 10.08 cents.

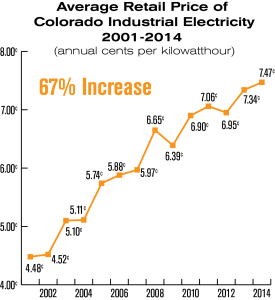

Industrial rates have tracked with the overall rate increase of approximately 67 percent, from 4.48 cents to 7.47 cents per kilowatthour.

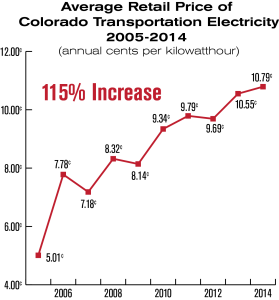

Transportation figures from EIA data do not extend back to 2001. Instead, the trackable data begins in 2003, with a sharp decline by 2005, before prices more than doubled, from 5.01 cents to 10.79 cents per kilowatthour, or a 115 percent increase in the last full 10 years of EIA measurement.

Overall increases for comparison (with the adjustment for transportation noted):

For a complete description of EIA definitions of electricity consumers and data collection, click here.